Editor’s note: You asked, and we went straight to the source for answers. My Buckhannon sat down with Upshur County Schools Interim Superintendent Dr. Debra Harrison and Finance Manager Jeffrey Perkins on Thursday to ask them some of our readers’ most frequently asked questions about the upcoming school levy vote.

Q: What is a levy?

Jeff Perkins: A levy is the taxes levied on the property you own. It provides about 9 percent of Upshur County Schools’ general expense budget, or just over $3.2 million. We have maintained the same tax rate of 47.7 percent since 1999. The current levy has been in effect since 1999.

Q: What does the levy support?

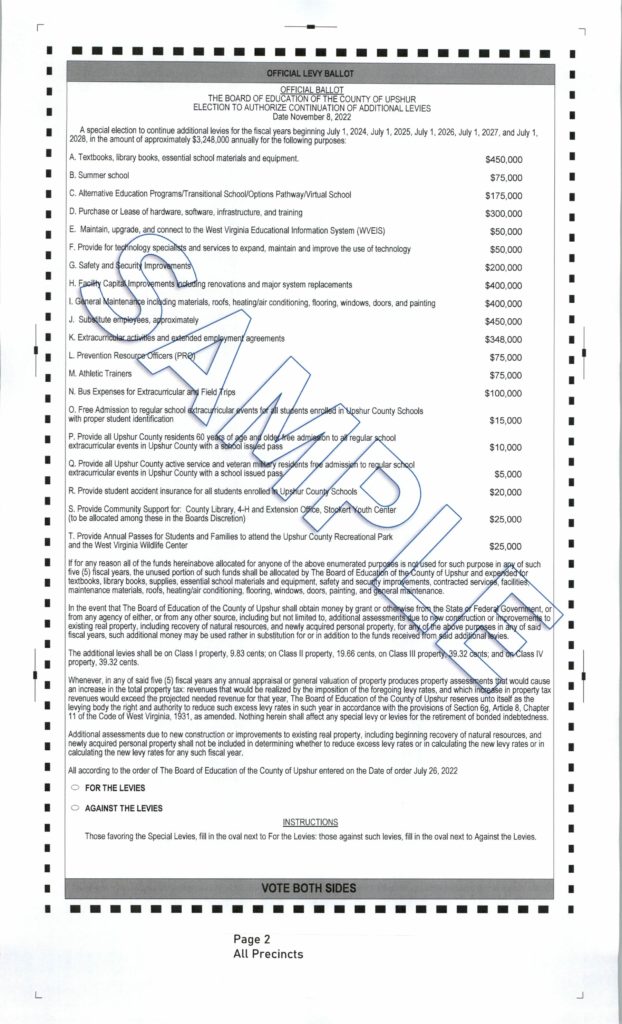

A: Generally, instructional programs, supplies and materials; technology access and improvement; capital improvements and preventive maintenance; and contracted services, but specifically:

- Purchase of textbooks, library books, essential school materials and equipment

- Salaries and wages for Prevention Resource Officers in schools, athletic trainers, technology specialists and substitute employees

- Facility capital improvements, including renovations and major system replacements

- Safety and security upgrades in Upshur County Schools

- Summer school, alternative education, transitional school, Virtual School and Options Pathway

- General maintenance, including materials, roofs, heating/air conditioning, flooring, windows, doors and painting

- Maintaining, upgrading and connecting to the West Virginia Educational Information System (WVEIS)

- Covering the cost of bus expenses for extracurricular activities and field trips

- Admission to extracurricular activities for Upshur County residents ages 60 and older, Upshur County students and annual passes for students and families to visit the Upshur County Recreational Park and West Virginia Wildlife Center

- Supporting community institutions, including the Upshur County Public Library, 4-H and WVU Extension Office, SYCC

Q: What is the difference between a bond and a levy? How is this different from the bond that failed in January 2022?

Debra Harrison: We have a lot of confusion about that. The way we try to explain it to people is that bonds are related to building, and when we were running the bond election, we were hoping to build a new high school and make the high school into a middle, and people definitely said to us, ‘we don’t want additional taxes to build a new high school.’

The levy is all about learning. All of the items that those dollar amounts go for are pieces that relate to student learning, even the fact that we fund local libraries, that we give money to Stockert Youth and Community Center, to 4-H and to parks and recreation – those are all ways to assist our students. Even giving free admission to senior citizens and veterans, that allows the students’ family members to go support their children and grandchildren at no cost.

We’re very fortunate because our kids get anything they need as far as supplies, and one of the pluses about that, honestly, is no matter what the socioeconomic level a child comes from, when they come into the classroom building, they’re all on a level playing field – they all have the same textbooks, they all have the same iPads and computer technology, they all have access to the same materials. We are very fortunate in that we are able to provide every student in this county with the opportunity to take that level playing field and go wherever their abilities allow them to go.

So, everything that is included can be brought back to doing what is best for students and doing what is best for teaching and learning. It doesn’t have anything to do with new construction. The point Mr. Perkins always makes is, this is how the dollars have to be spent, so our public, our community will know exactly how those dollars will be spent. We can’t use them for anything else.

Q: Will my taxes increase if the levy renewal passes?

Jeff Perkins: They will not. They will remain the same.

Q: Will our taxes go down if the levy renewal doesn’t pass?

Jeff Perkins: Yes. To calculate how much less, I have taken a house valued at $100,000 because that is the median; taxes payable on that would be $117.96 a year. If you are covered under the Homestead Act, taxes payable on that same $100,000-dollar house would be $78.64 a year.

On vehicles, Class III and Class IV, which also includes rental business properties and vacant land, taxes are assessed at a higher rate, so on that one, we used a market value of a $50,000 vehicle – and that might be two vehicles – but the taxes paid on that $50,000 vehicle would be $117.96 a year.

Q: Why are we voting on this now?

Jeff Perkins: Normally, our levy would not be requested for another two years, but due to a change in state law that did away with special elections, all levy elections have to be on the May Primary Election ballot or the November General Election ballot. There will no longer be special elections, and the selling point was the costs that would be saved on special elections (i.e., ones held in January, for instance), so that threw us into a bit of a quandary.

Our levy is for five years, but Primary and General elections are every two years, so with every other cycle, we asked for a levy renewal a year-and-a-half in advance of when it was needed. Our current one lasts until June of 2024. The levy we are asking the voters to vote on this time starts July 1, 2024, and lasts through June 30, 2029. Hopefully, with the passage of this one, when the next one comes up in five years, it will be on cycle, and it will seem normal. Levies are every five years, and elections are in two- and four-year increments.

Q: Could you wait until May 2024 to run the levy?

Jeff Perkins: We could, but budgets are due prior to that date, so I have to have our budget to the State Auditor’s Office by April of 2024.

Q: Is this a levy or a special levy election?

Jeff Perkins: So, the legal terminology is that it’s a special election for the excess levy, even though it’s part of the General Election.