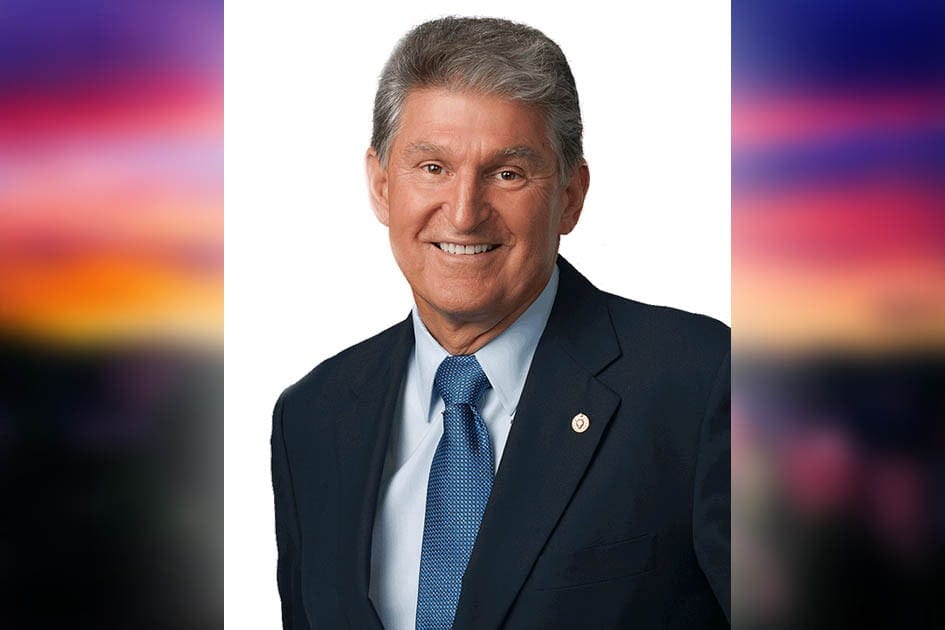

Washington, DC – This week, U.S. Senator Joe Manchin (D-WV) led three bipartisan colleagues in calling on the Trump Administration to provide employers relief and certainty related to their responsibility requirements under the Affordable Care Act (ACA). Specifically, the letter asks the Administration to consider safe harbors and flexibility measures regarding compliance with the employer shared responsibility requirements under the ACA.

Under the ACA’s employer shared responsibility provisions, certain employers must either offer minimum essential coverage to their full-time employees (and their dependents), or potentially make an employer shared responsibility payment to the IRS. This provision is sometimes referred to as “the employer mandate”.

During the COVID-19 pandemic, with businesses being forced to close or significantly modify staffing needs, the complex compliance burdens of tracking employees’ hours for full-time employees have been further compounded and may subject a business to an unforeseen tax penalty. This letter seeks to provide employers with some relief and certainty during this unsettling time.

The Senators said in part, “The impact of the COVID-19 pandemic continues to be felt by businesses across the United States. Navigating these uncertain times have become increasingly complicated by existing regulatory requirements which threaten to further upend these businesses. So, as the Administration continues its work to provide businesses with regulatory relief related to the COVID-19 pandemic, we respectfully request that you consider safe harbors and flexibility measures regarding compliance with the employer shared responsibility requirements under the Affordable Care Act, Code section 4980H.”

Read the full letter below or click here.

Dear Secretary Mnuchin and Commissioner Rettig:

The impact of the COVID-19 pandemic continues to be felt by businesses across the United States. Navigating these uncertain times have become increasingly complicated by existing regulatory requirements which threaten to further upend these businesses. So, as the Administration continues its work to provide businesses with regulatory relief related to the COVID-19 pandemic, we respectfully request that you consider safe harbors and flexibility measures regarding compliance with the employer shared responsibility requirements under the Affordable Care Act, Code section 4980H.

As the sponsors of the Employee Flexibility Act, we are aware of how complex tracking employees’ hours under 4980H for the full-time employee and applicable large employer definitions under normal circumstances can be. However, during the COVID-19 pandemic, with businesses being forced to close or significantly modify staffing needs, the compliance burdens and tracking requirements of Code section 4980H have been further compounded and may subject a business to an unforeseen tax penalty.

At a time when businesses are struggling, we request you provide employers with some relief and certainty. We believe safe harbors and flexibility measures for 4980H are consistent with the Regulatory Relief to Support Economic Recovery Executive Order 13924 and relief already given in other areas of the Code. We thank you for your attention to this request.