CHARLESTON — Gov. Jim Justice has issued a proclamation, calling for the West Virginia Legislature to convene in Special Session on Monday, July 25, 2022, at 12:00 p.m.

The Special Session call contains one item: the Governor’s proposal to reduce West Virginia’s personal income tax. Click here to review the proposed legislation.

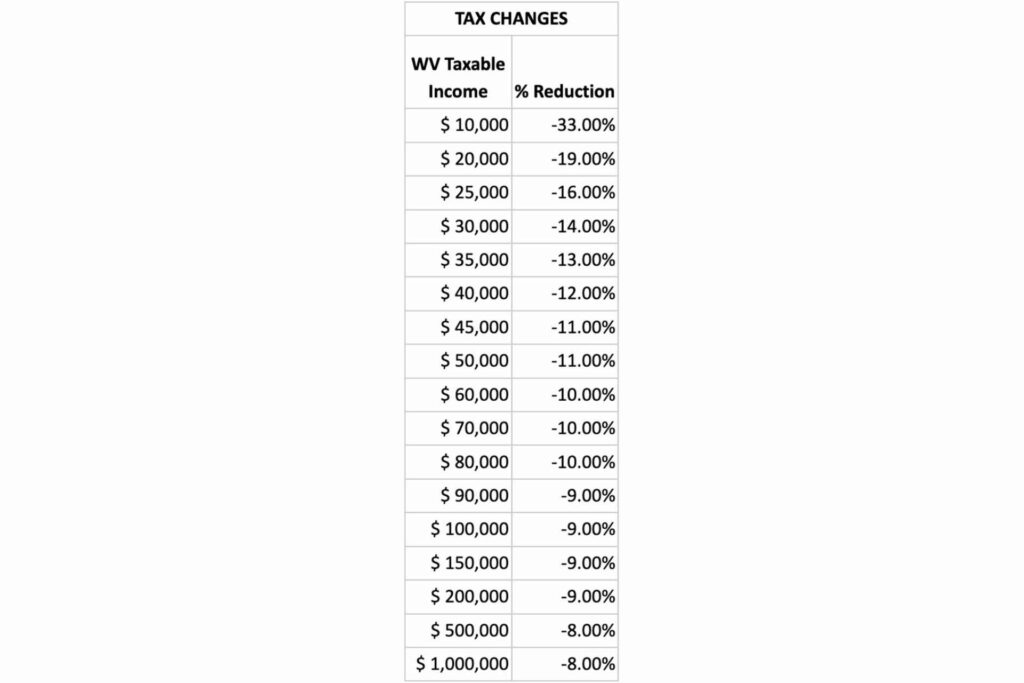

Justice announced his proposal to permanently cut the personal income tax by an aggregate of 10%. Under the Governor’s proposal, the aggregate 10% tax cut will be retroactive back to January 1, 2022, which the governor says will put $254 million back in the pockets of West Virginians.

“I’ve been the biggest proponent of completely eliminating our state personal income tax. It will drive job growth, population growth, and prosperity in West Virginia. But the most important thing to do is get started right away,” Gov. Justice said. “In the past year, gas prices have gotten out of control and inflation is through the roof. West Virginians need help right now.

“Once we get the ball rolling, we can keep coming back and chipping away at our personal income tax until it’s completely eliminated,” Gov. Justice continued. “When you look at states like Florida, Texas, and Tennessee, they have no personal income tax and their state economies are growing like crazy. There is a direct correlation. People are moving to no-income-tax states because they can keep more of their hard-earned paycheck, which spurs ever greater economic activity. It’s a cycle of goodness producing goodness. That’s what I want in West Virginia, and I hope that the Legislature will agree with me and pass this bill.”

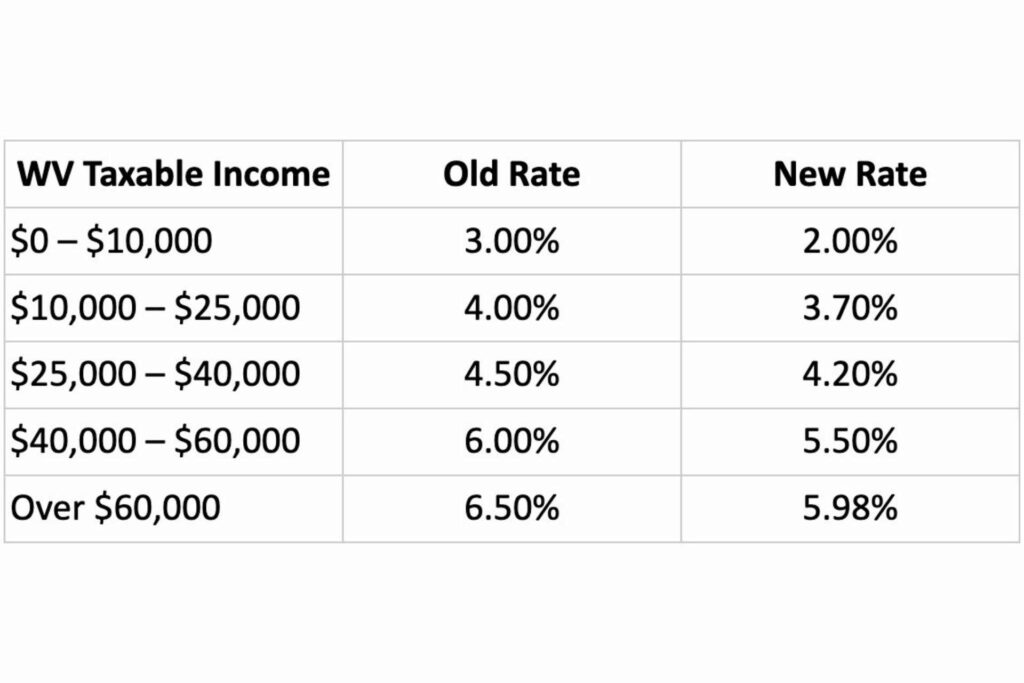

Under the Governor’s proposal, the State personal income tax brackets will remain the same, while the tax rates – which haven’t changed since 1987 – will drop for West Virginians at every income level.

These revisions will be retroactive to Jan. 1, 2022. Withholding tables will be revised by Oct. 1, 2022.